Industrial Property: Delivering Results, Securing Your Future

Unlock the potential of high-performing industrial assets, backed by global and national brands. Positioned in strategic locations, these properties offer secure leases, strong yields, and long-term value. Explore investments that are built to thrive.

Why Industrial?

Industrial property remains one of Australia’s most resilient and sought-after asset classes, underpinned by rising investment volumes, strong tenant demand, and long-term lease security. In 2024, industrial investment surged to $8.8 billion—a 36% increase from the previous year, with both institutional and private investors competing for premium assets.

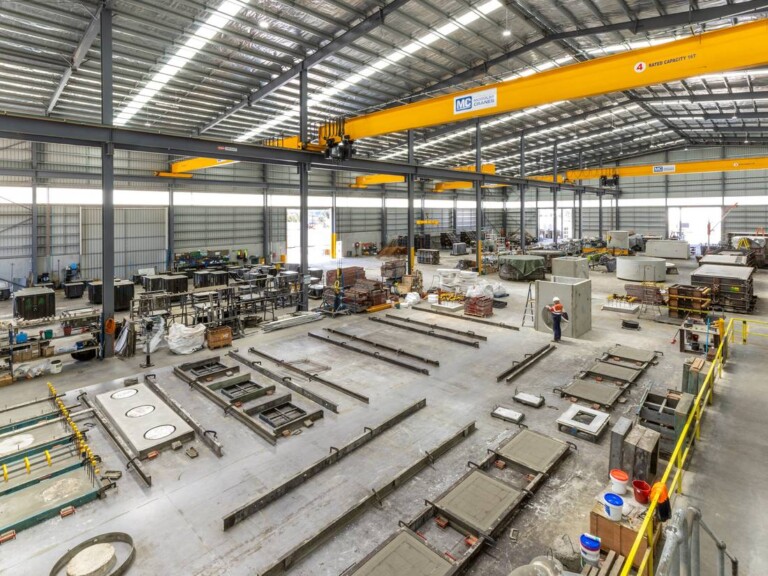

With prime industrial rents increasing by 4.1% over the past 12 months, and industrial vacancy rates remaining low, demand continues to outstrip supply. Global logistics giants like Amazon and FedEx, alongside major Australian players such as Civilmart, Woolworths, and Coles, are driving the expansion of warehousing and distribution facilities, securing industrial’s position as a powerhouse sector. Investors are drawn to fixed annual rent escalations, blue-chip tenant covenants, and strategic locations near key infrastructure hubs.

As e-commerce accelerates, supply chains evolve, and national infrastructure projects expand, industrial property is positioned for long-term capital growth and stability. Whether in major metropolitan precincts or high-growth regional markets, industrial assets offer high yields, strong lease security, and a future-proof investment opportunity.

Current Opportunities

Stay Ahead in Industrial

Investing in Industrial: Opportunities and Insights

Discover what's driving unprecedented demand for industrial assets.

Why Now Could Be the Best Time to Sell Your Industrial Property

Is now the right time to sell your industrial property? Find out now.

The Industrial Revolution | How Global Giants Are Transforming Australia’s Commercial Property Landscape

A simple cardboard box has become the icon of modern commerce. Behind every delivery lies...

Portfolio Podcast Ep 6: The Industrial Evolution – What’s Driving Demand?

The Portfolio Podcast explores current trends and key takeaways from recent sales.

Recent Highlight Sales

Ready to Explore Industrial Investment Opportunities?

Connect with us today to discuss your investment goals and learn more about the premium assets in our current portfolio.

Be the first to receive new listings and news direct to your inbox.

Stay up to date© CBRE 2026. All Rights Reserved