Burgess Rawson from CBRE in conjunction with CBRE are pleased to present Ampol Coolum Beach, located at 43-45 Junction Drive, Coolum Beach (Sunshine Coast) QLD 4573 for sale via Investment Portfolio Auction 181.

The opportunity has the following investment highlights:

+ Renewed five (5) year net lease to Ampol to September 2028 plus one (1) further five (5) year option to 2033

+ Ampol (ASX: ALD): ASX100 listed company with 1,800+ sites nationally & a market cap of $6.29 billion

+ Trophy 2,112sqm* corner landholding zoned ‘medium impact’ with 107m* of dual street frontage to Junction Road and Access Crescent

+ Perfectly positioned Ampol unmanned Truck Stop, positioned within immediate proximity of the Aqua Park Coolum, complementing the busy location and vehicle exposure

+ Highly accessible and very tightly held industrial location, with direct access to Sunshine Motorway (30,000+ vehicles passing daily*) and Yandina-Coolum Road (15,000 vehicles passing daily*)

+ 15,715 motor vehicles and $26 million spending on fuel per annum within a 5km* radius of the property*

+ Exceptional annual rent increases minimum 2.75%, ensuring continued income growth

+ Set-and-forget net lease structure, with the tenant responsible for 100% of outgoings, including land tax

+ Importantly, for future development under the lease provisions, the tenant is responsible to monitor, maintain, service, repair and remediate the site

+ Sunshine Coast: one of Australia’s fastest growing regional areas with a population over 377,000 which is forecast to grow to by 33% to over 500,000 residents by 2041

+ Net Income: $198,328 pa* + GST

For Sale via Investment Portfolio Auction 181

10.30am AEST Thursday 11 December 2025

Elevate Room, The Westin, Brisbane

Also available as part of Burgess Rawson’s December Portfolio Auction:

– Ampol Caloundra (Sunshine Coast)

Please contact the exclusively appointed sales team for more information.

*Approx.

Burgess Rawson from CBRE is pleased to present to the market Best & Less Gunnedah, located at 232-234 Conadilly Street, Gunnedah NSW, for sale via Private Treaty.

The opportunity has the following investment highlights:

+ New five (5) year net lease to June 2030 plus one further five (5) year option extending to 2035

+ Best & Less: multi-national apparel retailer with 245 locations across AUS & NZ, providing a wide variety of apparel, babywear, and home goods

+ Landlord friendly net lease, tenant responsible for 100% of outgoings including council rates, water rates, insurance and land tax (single holding basis), as per the lease

+ Easily managed single tenanted investment

+ Highly prominent location on the main thoroughfare through Gunnedah’s CBD, in close proximity to national tenants ALDI, Coles, Kmart, Mitre 10 and McDonald’s

+ Large 1,707sqm* CBD freehold landholding improved by 19 on-site car spaces

+ Gunnedah Shire: established regional NSW township with a population of 13,392¹ and a GRP of $2.23 billion², as well as a major producer of beef for all of Australia

+ Net Income: $145,820 pa* + GST

For sale via Private Treaty

Please contact the exclusively appointed sales team for more information

*Approx

1 profile.id

2 economy.id

Burgess Rawson from CBRE is pleased to offer to the market 7-Eleven, Horsham (Wimmera Highway) VIC for sale via Private Treaty.

This opportunity has the following key investment highlights:

+ Twelve (12) year corporate lease to 2037 plus four (4) further five (5) year options to 2057

+ 7-Eleven: Australia’s #1 convenience retailer with 760+ stores, purchased for $1.71 billion¹ by 7-Eleven International LLC operating 46,000+ sites globally.¹

+ ChargeStop Australia delivers market leading ultra-fast EV charging hubs strategically located nationwide.

+ Head lease to 7-Eleven, with 7-Eleven responsible for all outgoings including rates, insurance & management.

+ Strong rental growth with annual fixed compounding 3% increases

+ High exposure 1,657sqm* corner site boasting 118m* of highway frontage with integral dual street ingress and egress.

+ Constructed in 2025, this purpose-built facility features the latest specifications and significant tenant capital investment, providing substantial tax depreciation benefits for investors.

+ Potential 50% stamp duty savings.

+ Strategically located within the Horsham CBD and surrounded by key blue-chip national retailers; Coles, Woolworths, BWS, Bunnings, Aldi, Target, Harvey Norman and more.

+ Horsham: Capital of North-Western Victoria midway between Melbourne and Adelaide with a GRP of $3.8 billion.²

+ Net income: $381,225 pa* + GST

To be sold via Private Treaty

Please contact the exclusively appointed sales team for more information.

*Approx

1 7-Eleven

2 Remplan

Burgess Rawson from CBRE is pleased to offer to the market 1/41 & 43 William Street, Gosford NSW, for sale via Expressions of Interest, closing Thursday, 4 December 2025.

The property has the following key investment highlights:

+ Longstanding net leases to PRP to 2030 plus further option to 2035

+ Leased to PRP Diagnostic Imaging: leading diagnostic imaging provider with 32 locations and growing, servicing 1 million+ patients annually, owned by IFM Investors & UniSuper with a combined $381 billion¹ Assets Under Management

+ Strategic Gosford CBD location, next to key $650 million “Gosford Alive’ mixed use development¹, The Imperial Centre (anchored by Woolworths & McDonald’s) and key ancillary healthcare tenants including Douglas Hanly Moir Pathology

+ Favourable development controls including 4.75:1 FSR & a 36m* building height limit (STCA)

+ Versatile B4: Mixed Use zoning

+ Net lease structure with tenant paying all outgoings as per lease, including council rates, insurance, repairs & maintenance, management fees and land tax

+ Annual reviews to the greater of CPI or 3%

+ Gosford: economic hub of the Central Coast with a population of 178,000+, with the largest industry by employment is Healthcare²

+ Net Income: $411,505 pa* + GST

To be sold via Expressions of Interest closing Thursday the 4th of December at 2pm AEDT.

Also available as part of the ‘PRP Medical Imaging Portfolio’

+ PRP Shellharbour (South Coast), NSW

+ PRP Bathurst (Central West), NSW

+ PRP Westmead (Western Sydney), NSW

Please contact the exclusively appointed sales team for more information.

*Approximate

1 IFM & Unisuper

2 profile.id

Burgess Rawson from CBRE is pleased to offer to the market Zarraffa’s, Caboolture (Cnr Morayfield Rd) QLD for sale via our Investment Portfolio Auction 181.

This opportunity has the following key investment highlights:

+ Brand new fifteen (15) year lease to 2040 plus four (4) further five (5) year options through to 2060

+ Zarraffa’s: Established in 1996, Zarraffa’s is a nationally recognised QSR chain with 75+ stores nationally and growing across Australia.

+ Compounding fixed 3.5% annual rent increases ensuring long term compounding income growth

+ Favourable lease structure – tenant pays all rates, insurances, cleaning, management fees and general repairs and maintenance.

+ Latest specification design dual drive-thru restaurant, adjoining national tenants Oporto, EG/Ampol & Carl’s Jr

+ High density landholding with 19m* of street frontage to Frank Street, and with direct access to Morayfield Road, offering exposure to 245,000 vehicles passing weekly¹

+ Favourable planning controls and high density landholding zoned for 7-levels.

+ Strategically positioned within 350m* of the Morayfield Shopping Centre, anchored by Coles, Woolworths, Rebel, Big W, Kmart and more, boasting over 6 million customers annually.²

+ Brand new construction completed in 2025, offering maximum depreciation benefits

+ Part of the busy new convenience retail & fast food development including Oporto, EG/Ampol & Carl’s Jr.

+ Caboolture: 35km* from Brisbane CBD, one of Australia’s fastest growing regions.

+ Major investment into the Moreton Bay Region with the City of Moreton Bay handing down a landmark $1 billion budget into improving the region in its FY25-26 budget.³

+ Caboolture: Booming growth corridor with a median house price which has increased by 61% since April 2021.⁴

+ City of Moreton Bay: Australia’s third largest LGA by population, forecast to grow to over 796,000 by 2046⁵ and currently generates $19.9 billion in gross regional product supported by over 158,800 local jobs.⁶

+ Net Income: $95,000 pa* + GST

To be sold by Investment Portfolio Auction

10:30am (AEDT) Tuesday 9 December 2025

Yallamundi Rooms, Sydney Opera House

Please contact the exclusively appointed sales team for more information.

*Approx

1 GapMaps

2 realcommercial.com.au

3 City of Moreton Bay

4 realestate.com.au

5 Queensland Regional Profiles: Resident – Moreton Bay

6 Profile.id

Burgess Rawson from CBRE are pleased to present Ampol Caloundra West, located at 20 Newing Way, Caloundra West (Sunshine Coast) QLD 4551 for sale via Investment Portfolio Auction 181.

The opportunity has the following investment highlights:

+ Renewed five (5) year net lease to Ampol to September 2028 plus one (1) further five (5) year option to 2033

+ Ampol (ASX: ALD): ASX100 listed company with 1,800+ sites nationally & a market cap of $6.29 billion

+ Prized 1,577sqm* corner landholding zoned ‘medium impact’ with important dual access and 70m* of frontage to Newing Way

+ Strategically located Ampol unmanned Truck Stop, positioned within immediate proximity to national retailers Bunnings, Total Tools, Tyre Power, Burson Auto Parts, Mitre 10, Petbarn, Chemist Warehouse, Repco and Bob-Jane T-Marts

+ 47,531 motor vehicles and $75 million spending on fuel per annum within a 5km* radius of the property

+ Highly accessible industrial location, with direct access to Nicklin Way (60,000+ vehicles passing daily*) and Caloundra Road (30,000+ vehicles passing daily*), and positioned within 4km* of the Caloundra CBD

+ Exceptional annual rent increases minimum 2.75%, ensuring continued income growth

+ Set-and-forget net lease structure, with the tenant responsible for 100% of outgoings including land tax

+ Importantly, for future development under the lease provisions, the tenant is responsible to monitor, maintain, service, repair and remediate the site

+ Sunshine Coast: one of Australia’s fastest growing regional areas with a population over 377,000 which is forecast to grow to by 33% to over 500,000 residents by 2041

+ Net Income: $103,339 pa* + GST

For Sale via Investment Portfolio Auction 181

10.30am AEST Thursday 11 December 2025

Elevate Room, The Westin, Brisbane

Also available as part of Burgess Rawson’s December Portfolio Auction:

– Ampol Coolum Beach (Sunshine Coast)

Please contact the exclusively appointed sales team for more information.

*Approx.

Burgess Rawson from CBRE is pleased to offer to the market the ACARES Specialist Disability Accommodation (SDA) facility located at 7 Ararat Street, Tarneit VIC for sale via Private Treaty.

The property has the following key investment highlights:

+ Ten (10) year lease to ACARES to October 2031 plus Two (2) additional Ten (10) year options to 2051 (circa 5 years remaining).

+ ACARES: subsidiary of Zenitas Healthcare, ACARES is a leading Australian provider of disability, aged care, and health services.

+ Purpose-built 274sqm* 3-bedroom (plus OOA) SDA building constructed to ‘High Physical Support’ standards.

+ Strategic 508sqm* corner freehold landholding with important 46m* dual street frontage to Ararat Street & Benambra Street.

+ Fixed, compounding, annual 2.5% rent increases, ensuring income growth.

+ Land tax exempt investment opportunity.

+ ACARES is responsible for all usual outgoings including rates and insurance premiums.

+ Conveniently located just 900m* from ALDI and a full-line Coles Supermarket.

+ Tarneit: one of Australia’s fastest growing city-fringe locations with population set to surge 73.39% by 2046 to more than 125,000 residents. (1)

+ City of Wyndham: home to more than 337,000 residents, the City of Wyndham supports 91,224 jobs and has an annual economic output of $37.867 billion.(2)

+ Net Income: $86,225 pa*.

To be sold by Private Treaty

*Approx

1 .id

2 REMPlan

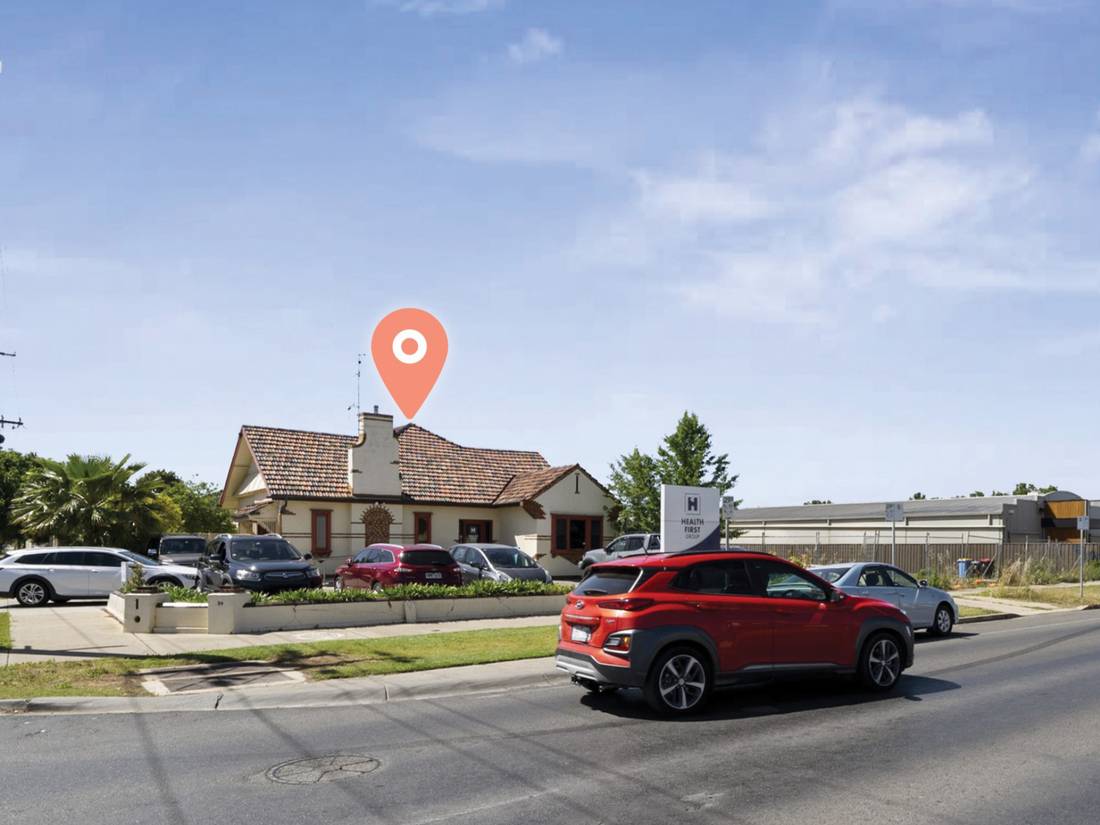

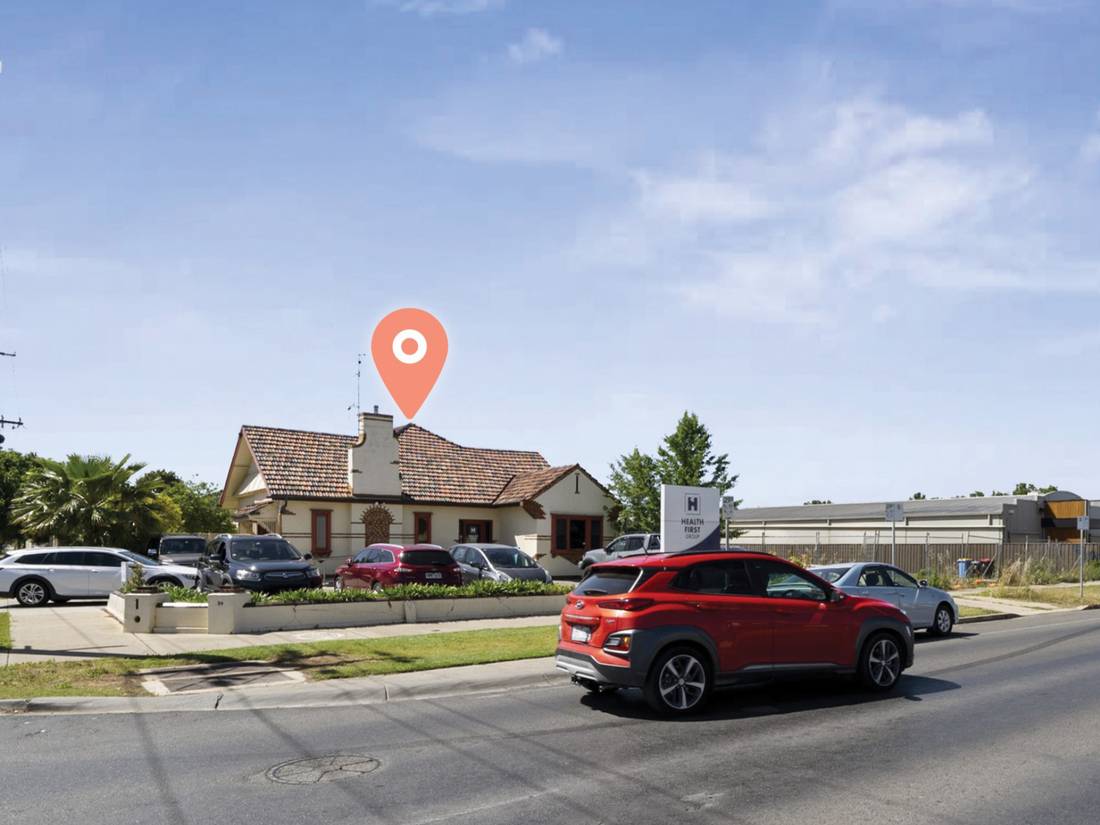

Burgess Rawson from CBRE and Gagliardi Scott Real Estate are pleased to offer to market the Health First freehold located at 39 Wyndham Street (Goulburn Valley Highway), Shepparton VIC via National Portfolio Auction 181.

This property has the following key investment highlights:

+ Renewed Five (5) year lease to February 2030 plus option to 2035.

+ Health First Group: one of Australia’s largest allied health providers with 16+ locations nationally. (1)

+ The Shepparton clinic is a registered NDIS provider and offers physiotherapy & occupational therapy services.

+ Proven physiotherapy location of 9 years.

+ Investor preferred net lease terms, tenant pays all usual outgoings including building insurance.

+ Guaranteed income growth via fixed 3% annual rent increases.

+ 200sqm* physiotherapy clinic incorporating consult, dental and exercise rooms.

+ Strategic position in heart of key medical precinct, amongst private hospital, GP clinics, pathology and more.

+ Only 685 metres* from Goulburn Valley Health, the major hospital in the region.

+ Prime 718sqm* ACZ1 corner landholding with dual frontage and 7 on-title patient car parks.

+ High profile Goulburn Valley Highway position with 29,000 vehicles passing daily. (2)

+ Potential 50% stamp duty saving.

+ Shepparton: major regional city with 70,000+ trade catchment.

+ Net Income: $58,388pa* + GST (3)

For Sale via Investment Portfolio Auction 181

10:30am AEDT Wednesday 10 December 2025

Crown Casino, Melbourne VIC

*Approx

1. Health First Group

2. GapMaps

3. as at 1 February 2026

Burgess Rawson from CBRE are pleased to offer to market the Chemist Warehouse anchored freehold located at 60 Beaumont Street (corner Cleary Street), Hamilton (Newcastle) NSW via National Portfolio Auction 181.

This property has the following key investment highlights:

+ Anchored by renewed Five (5) year lease to Nov 2030 to Chemist Warehouse plus option to 2035.

+ Chemist Warehouse: wholly owned by ASX listed Sigma Healthcare with current market cap of $35.96 Billion. (1)

+ Commanding 1,146sqm* two level building incorporating Chemist Warehouse, law firm and advisory.

+ Proven location with strong occupancy history.

+ Majority net lease terms with tenants paying all usual outgoings as per leases.

+ Guaranteed income growth via fixed 3% & 4% annual rent increases.

+ High profile 613sqm* corner landholding with 70 metre* triple street frontage.

+ Desirable site in heart of Hamilton’s premier retail strip with future development upside STCA.

+ Situated amongst IGA supermarket, Australia Post, Guzman Y Gomez, Zambrero and all major banks.

+ Only 300 metres* from Hamilton train station.

+ Newcastle: booming city with 175,000+ retail trade catchment.

+ Net Income: $310,164pa* + GST

For Sale via Investment Portfolio Auction 181

10:30am AEDT Tuesday 9 December 2025

Sydney Opera House

*Approx

1. ASX

Burgess Rawson from CBRE, together with Colliers International Ballarat are delighted to present to market the Independent Living facility at 206 Creswick Road (Midland Hwy), Ballarat Central VIC for sale by Auction on Wednesday 10th December at the Crown Casino in Melbourne.

+ Renewed 5 year lease to June 2029 plus option to 2034.

+ Fixed 3% annual rent increases.

+ Landlord favourable net lease terms with tenant paying all usual outgoings as per the lease.

+ Independent Living Specialists: Australia’s #1 retailer for mobility & rehab equipment, 50+ locations and growing.

+ Independent Living Specialists: our motto ‘Movement is a Medicine for creating change in person’s Physical, Emotional and Mental State’.

+ Absolute position perfect Hwy location, central between Bunnings & Officeworks and close to Ballarat Base Hospital.

+ 1,310sqm* freehold site with on site parking and dual access including rear loading (ROW).

+ Commercial 1 & Industrial 1 zoning.

+ Immaculate and versatile 702sqm* tilt slab building with mezzanine constructed 2009

+ 21,210 vehicles passing daily**

+ Ballarat: capital of Western Victoria, population forecast to surge 32% to 164,365 by 2046***

+ Ballarat: Geographical significance of the area evident through ongoing government funded development projects; to be completed by 2027, the $655 million. Ballarat Base Hospital Redevelopment will allow the facility to treat an additional 32,500+ patients each year ****

+ Potential 50% stamp duty saving.

+ Net Income: $138,020pa* + GST

To be sold via Investment Portfolio Auction

10:30am AEDT Wednesday 10th December 2025

Crown Casino, Melbourne

* Approx

** GapMaps

*** Forecast.id

**** VIC Gov