Huge Appetite for Fast Food Assets

Fast Food assets have proven to be one of the most sought after commercial investments in Australia, and it’s no wonder considering how the industry boomed during the pandemic.

These proven set-and-forget investments were the go-to during lockdown, with an astonishing 15.9 million Australian’s recorded eating takeaway Food in an average four week period.

Burgess Rawson are the leaders in Fast Food investment sales with a market share of 71%.

A dedicated and highly experienced team focusing on the ever-evolving Fast Food industry is unrivaled in their knowledge.

The team as a whole sold 22 Fast Food investments in the 21/22 financial year, achieving record yields and delivering strong outcomes for both investors and vendors alike.

Fast Food asset demand has grown because it’s a set-and-forget long-term investment

The hunger for Fast Food assets continues to dominate the commercial industry as these tightly held essential service investments continue to sell on an upward trajectory, achieving high capital growth and record low yields.

Existing landlords regularly seek to acquire additional assets rather than divest, and this combined with a shortage in supply has led to sustained yield compression.

Demand will continue to remain high as Fast Food assets tick many boxes for commercial property investors including;

• Long-term leases paid to reputable global brand and growing local brand tenants

• Range of price points for every investor

• Tenants embracing technology eg. self serve, apps, and online ordering

• Brands evolving to meet market demands, such as introducing healthier menu items

• A ‘set-and-forget’ investment, due to lease nature and minimal owner involvement

Brands carry weight

Well-established multi-nationals have dominated the sector, however, in recent years there has been significant growth and expansion amongst local Australian brands such as Grill’d, which has grown from its first store in Melbourne in 2004 to 155 locations, and Guzman Y Gomez established in Sydney in 2006 has grown to 148 locations in 2022.

Guzman Y Gomez has taken a further leap, opening 16 restaurants internationally, including 148 in Australia.

Leases commitments are long and landlord-friendly

Tenants typically seek long-term leases providing investors with security, and the ability to achieve long-term asset growth.

Leases are often a 10-year initial term, with the options extending by another 10 or 30 years.

Proven performances during the pandemic

Fast Food assets have not had to ‘pivot’ their business models unlike many local strip takeaway businesses and restaurants during lockdowns.

Fast Food operators have well-established service models – drive-thru has existed for decades, digital sales both online and in-store, and delivery have been key sales drivers for a number of years.

So, whilst lockdowns did restrict dine-in service for several months in 2020 and 2021, particularly in New South Wales and Victoria, the impact on revenue was minimal.

In fact, the forecast revenue growth for 2020-21 factoring in the reopening of dine-in at Fast Food outlets as Covid restrictions eased was just 0.9%, so a marginal increase as the result of these assets having alternative no-contact sales channels.

Roy Morgan’s research into takeaway consumption from Fast Food outlets in 2020 shows these assets were actually beneficiaries of lockdowns as many Australians stuck at home took advantage of delivery services to order their favourite Fast Food1 :

• Close to three-quarters of Australians aged 14+ or 15.9 million (75.3%) ate takeaway Food from Fast Food outlets such as McDonald’s, KFC, Hungry Jack’s, Domino’s or from local takeaway shops in an average four weeks during 2020, up from 13.3 million (63.7%) in 2019

• 3.7 million Australians (17.6%) ate from these outlets 10 or more times in an average of four weeks

• The biggest consumer segment or Fast Food purchasers are those born between 1976-1990, aged 31-46, with 5,915,000 indulging over an average 4-week period

A strong outlook for the Australian Fast Food industry

The top four players in the Fast Food sector accounted for over 40% of revenue in 2021, led by McDonald’s (1,030 outlets), Hungry Jack’s (449 outlets), KFC (732 outlets) and in fourth position, Subway (1,242 outlets).

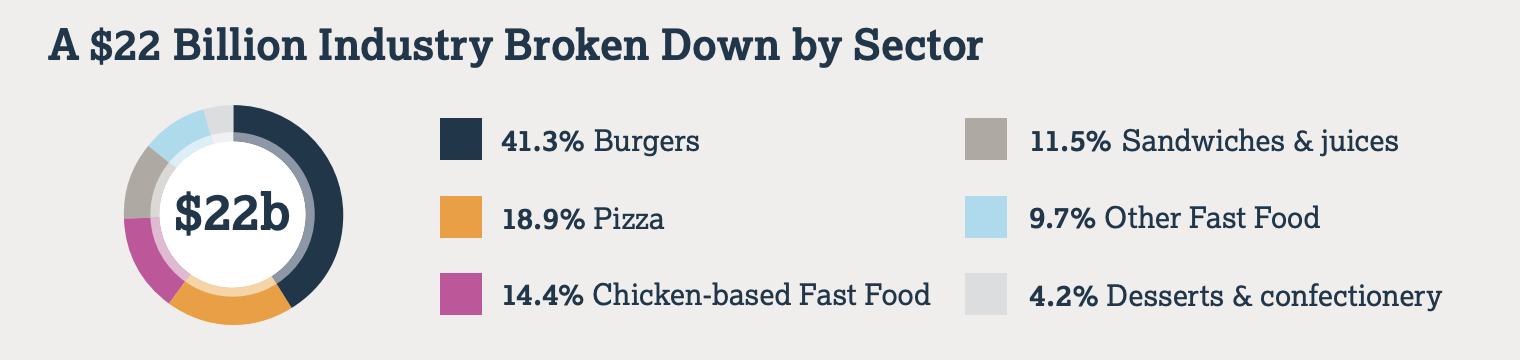

The Fast Food and takeaway industry Australia is expected to achieve $22 billion in revenue during 2022 and is forecast to continue to grow over the next five years as consumers seek greater convenience, and operators introduce even healthier menu options to continue to satisfy consumer demand.

This maturity and predicted shift de-risks the investment for Fast Food landlords.

A proven, secure long-term investment, appetite for Fast Food assets is set to continue, and Burgess Rawson is at the forefront of sales in the category, bringing six opportunities to investors at our upcoming August Portfolio.

Our team of experts delivers positive results, making us the agency of choice amongst Fast Food vendors.