Focus on Tasmania

The incredible growth of Australia’s commercial property market in recent years is no secret.

But what might surprise you is which markets are at the top of the class when it comes to recent performance.

While Melbourne and Sydney remain Australia’s largest markets and major targets for buyers, it’s out southernmost state that is punching well above its weight and delivering some of the most enticing returns for investors.

Why Tasmania? Here’s a snapshot of what’s making Australia’s apple isle such a brilliant commercial property proposition.

Population

When it comes to demand for both commercial and residential property investment and development, population growth continues to be a significant driver.

On that score, Tasmania is showing remarkable strength and some of the most promising results nationally.

Commsec’s January State of the States report shows Tasmania has the strongest relative population growth of any state in the country, with its 1.13% annual population growth rate almost double their decade average.

The Tasmanian Government projections show the state’s current population growing from around 535,000 to almost 570,000 by 2042. Much of that increase will be generated in the Greater Hobart area, which the Tasmanian Department of Treasury and Finance expects to boom by almost 20% between 2017 and 2042.

This will be driven through migration from overseas and younger age-profiles.

Services and existing industries will benefit heavily from this growth, fuelling ongoing demand in the sales, leasing and development sectors of the commercial property market, and construction, where gross state product increased by 8.8% in the 2018-19 year.

A Hive of Investment Activity

Investors have been quick to recognise Tasmania’s potential and are increasingly seeking to capitalise on the state’s comparative affordability and outstanding investment climate.

Tasmanian properties were among the most sought-after by investors at our Portfolio Auctions in the 18 months to December 2019, with 10 properties changing hands, including a Bunnings Warehouse at Glenorchy, which sold for $14.06 million on a yield of 3.13% – a record for any Bunnings property ever sold in Australia.

In June a strong of four car dealerships leased to automotive industry giant AP Eagers were snapped up – two of them by former Queensland premier Campbell Newman. In August a Centrelink call centre at Kings Meadows traded for $4.5 million, almost tripling in value in 10 years, while a Nandos fast food restaurant was one of five Tasmanian properties to sell at the April Portfolio Auction.

This level of interest and competition is reserved only for the strongest, most dynamic markets, and it’s clear that Tasmania is meeting that criteria for educated investors.

Development Projects

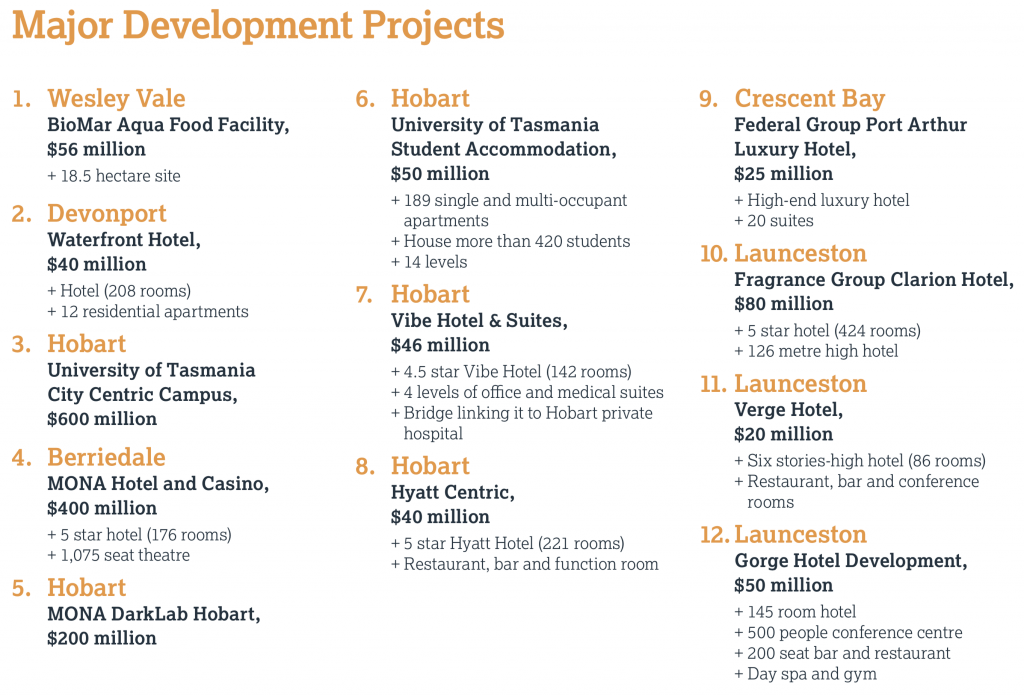

Few things speak to the potency of a commercial property market than the pipeline of development that exists within it.

Billions of dollars are currently at play in the state’s booming development industry, with both local and international developers seeking to capitalise on the strength in demand and the local economy.

Headlining the projects is the University of Tasmania’s new $600 million campus in Hobart, which is currently being promoted as a business case, while the state’s iconic art and tourism attraction MONA is in line for an accompanying $400 million hotel and casino.

Tellingly, international developers are increasingly active, with Singapore’s Fragrance Group leading the charge through the purchase of four major sites for hotel and residential developments, including the $80 million Clarion Hotel, which is in the development application phase, and a $30 million hotel on Macquarie Street in Hobert, which has already been designed.

Industry and Economy

Much has been made of Tasmania’s soaring real estate market, and the state’s economy of one of the key drivers.

Tasmania’s nominal economic growth was up by 5.5% over the year to September, second only to Western Australia, while its gross product per capita surged 2.3% in the last financial year – almost double the growth of the ACT, which recorded the next best result.

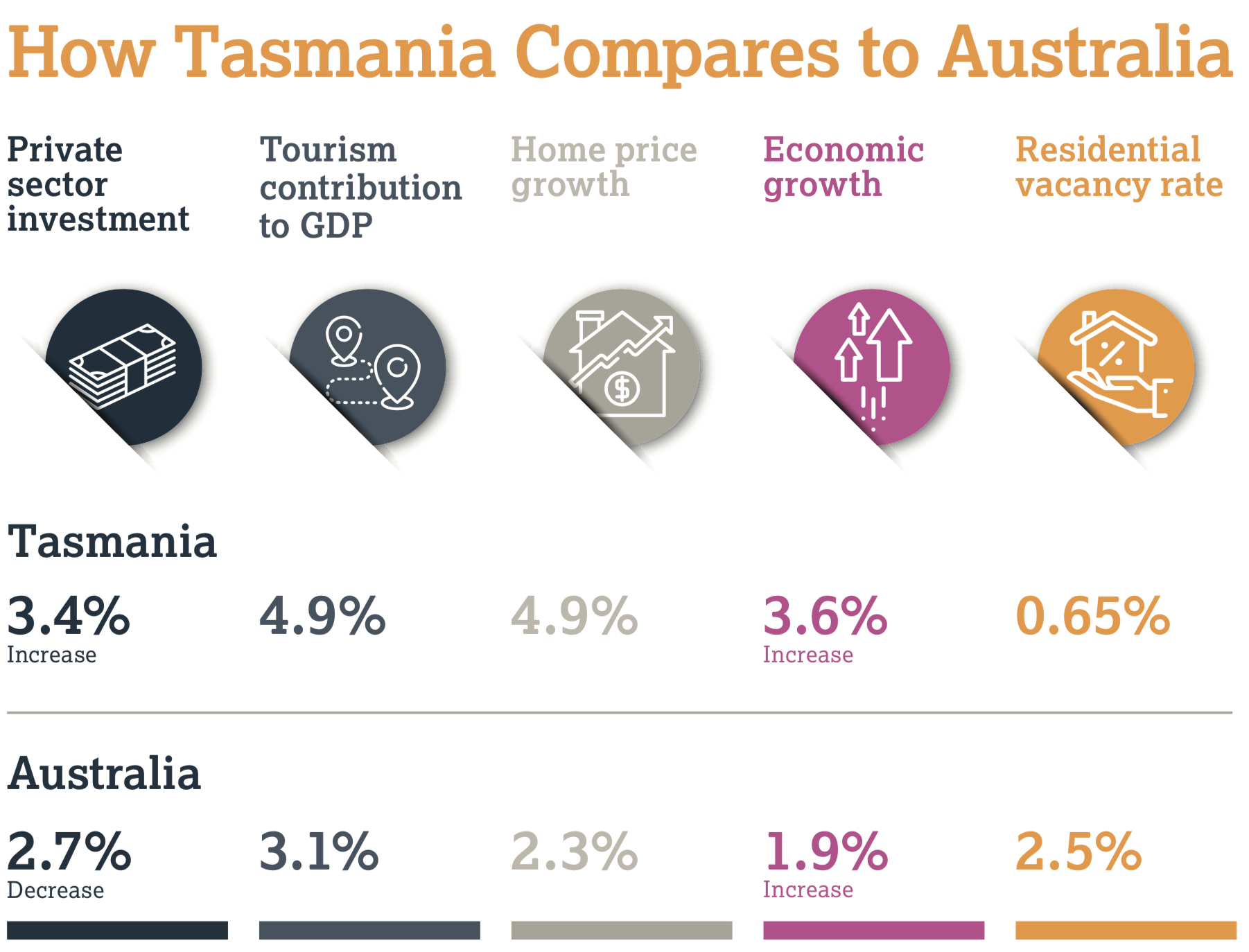

While Australia’s national level of private sector investment fell 2.7% in 2018/19, Tasmania experiences a 3.5% increase, proving unequivocally that investors and big business have exceptional confidence in transacting there.

In fact, every single industry in the state recorded positive growth, with healthcare services leaping 7.4% and even retail, which is facing challenges in other markets, climbing 1.2%.